Seller's Checklist

Contact J. Backer Group we will help you identify the most important aspect of selling your home.

- Why are you selling your home? Relocation, need more or less space, financial relief etc…

- When do you want or need to sell? Timing is the most critical element to the sales process

- Season – spring is the best time for sales, which will bring you more potential buyers and winter is the least attractive season which brings out less buyers.

- Price– the second most important element, if your property is not properly priced, your property will either sell too quickly (if priced below market) or else sit on the market long enough to be considered as a “stale” listing, lastly overlooked by everyone if priced too high in the current market.

- Market – the general trends of supply and demand can greatly affect the timing of a sale. Interest rate movements are the most significant factor for igniting or dampening sales.

- Prepping Your Home – J. Backer Group can help you with this!

- Is your home buyer ready? Staging the property to show it in its best form is the goal. A buyer has to see the vision of living there. Any one thing can turn a buyer off. It takes very little time for a buyer to make up their mind if they want to buy your home.

We at J. Backer Group will bridge the vision gap between you the seller and the buyer.

Clean and Freshen

- Clean bathrooms and kitchens until they shine.

- Clean Windows – open blinds and let the light in

- Target foul smells – smoking, pets and trash especially

Clean and Freshen

- The focus is to create visual space everywhere you can

- People are visual-especially Buyers!!

- Get rid of all clutter, clean off bookshelves, put away or throw out toys

- Clear off countertops and tables

- Clean and organize closets

- Dispose or store all unnecessary furniture

Clean and Freshen

- Fix minor things in the house, make it livable

- Repair faucets, replace missing knobs

- Replace missing door or cabinet handles

- Fix or replace broken appliances

- Paint if possible, using neutral colors or bright white. Paint brings a fresh look and smell!

Buyer's Checklist

- Get pre-qualified for a mortgage ( tells you how much you can afford to buy )

- Find out what your credit score is

- Contact J. Backer Group to represent you.

- How much do you want to spend on a home?

- How much do you have for a down payment?

- When do you want to move into your new property?

- How many bedrooms do you need?

- What neighborhoods are you most interested in?

- What is your preference for building style?

- Which amenities are essential to you?

- Is purchasing a home contingent upon something else taking place?

- Select an attorney-do not hire yet, but have someone in mind.

Planning ahead is about preparing for the future today. Consider your needs before you start your search. Think about the number of bedrooms, bathrooms, square footage, amenities, and most importantly LOCATION. Ensure arrangements are secured for a new home purchase or rental prior to putting your current home on the market. If need be, create a “To-Do” list, which outlines each step of the process. Use it as your “Next Step” guide for assuring the best results possible. You can never over prepare – but you can under prepare. J. Backer Group offers a seamless step-by-step method. ASK JBG ABOUT IT!

Renter's Checklist

Tenant Requirements:

Renting in New York City is an adventure. Here are a few ‘Must Knows’ from J. Backer Group:

Procrastination may cost you an apartment you truly want. New York City is famous for its excitement and fast movement; particularly in this market. If you are interested in joining the adventure, then your goal should be to move quickly and be prepared to avoid possible delays. Gather documents needed in order to support your ability to pay for the rent. Don’t forget, having your paperwork in order ahead of time will save you, your agent, and your potential landlord unnecessary stress. It will help you expedite & properly manage your rental process. If all of your paperwork is in place, let your search begin!

STOP: There are specific tenant requirements in order to qualify for most apartments in Manhattan. Along with good credit rating, a prospective renter must earn a minimum annual household income of 40x the monthly rent. If income or credit are lacking, you must be prepared to provide a guarantor, which is a person who guarantees to pay for your debt should you default on your obligation(s). The guarantor must earn a minimum annual household income of 80x the monthly rent. J. Backer Group recommends use of a family member living in the tri-state (New York, New Jersey, or Connecticut). For additional information, ASK JB ABOUT IT!

Requirements Below:

Fully completed application

- Copy photo I.D. ( drivers license, passport, non-drivers ID)

- Employment verification letter (On company letterhead, stating position, salary, bonus if applicable, length of employment and signed by the preparer include a contact phone number)

- Most recent tax returns, Form 1040 (first two pages only)

- Copy of three (3) consecutive pay stubs (most recent).

- Copy of most recent bank statement

- Proof of additional income/savings (stocks, bonds, savings, etc…)

- If Self-Employed, a letter stating position & income from your Accountant or Lawyer

Bright-side

NYC is filled with amazement. From the BEST landmarks and attractions, to tourism, eatery, culture, nightlife, and shopping. All of which, makes NYC a GREAT place to live. None of which is possible without people – the ‘melting pot’ – which brands NYC as the most unique & diversity city in world. Inhabitants worldwide continue to move here daily, in a quest to fulfill their dream(s). You may be feeling the same way too.

Dark-side

Renting an apartment in NYC presents certain challenges, causing astonishment to people who aren’t a custom to other cities. Due to NYCs fast pace, renting can be perplexing, pricy, aggressive, and at times, distasteful. However, it does not to be that way. J. Backer Group specializes in making your rental experience as pleasant & productive as possible. We treat our clients, staff, & agents equally. To sum it up, we are here to help. Don’t get wrapped up into the darker side of things, be sure to ASK JB ABOUT IT! The brighter side that is… Nevertheless, take a moment to review a few simple (yet) important points for consideration.

Guarantor's Checklist

- Fully completed application

- Copy photo I.D. (drivers license, passport, non-drivers ID)

- Employment verification letter. (On company letterhead, stating position, salary, bonus if applicable, length of employment and signed by the preparer include a contact phone number)

- Most recent tax returns, Form 1040 (first two pages only)

- Copy of three (3) consecutive pay stubs (most recent)

- Copy of most recent bank statement

- Proof of additional income/savings (stocks, bonds, savings, etc…)

- If Self-Employed, a letter stating position and income from your Accountant or Lawyer

Hire J. Backer Group

How much is your property worth? – Of course everyone wants the highest possible price for their property. However, establishing a proper initial price for your home is essential to a timely sale. Priced too high, you will be overlooked in favor of other options. Too low, you will be leaving money on the table. Ultimately, the value will be determined by a number of factors including property characteristics, market conditions, and skillful negotiation. Your J. Backer Group agent can prepare a comparative market analysis for you to help pinpoint the right initial asking price.

Create a strategic marketing plan –It’s important you tell your agent everything about the property, remember we are on your side! The best way to represent you and your home is to know the truth. Work with your J. Backer Group salesperson to create a detailed list of your property’s selling points. Discuss with your agent about strategies for marketing and advertising. Our agents have many credible outlets to advertise your property to the brokerage community and directly to potential buyers.

The commission –The seller is responsible for paying the commission to the Broker handling the sale of the property. In New York the commission is typically 6% of the sales price, this can be negotiated.

Get an attorney – As soon as you decided to sell your home get an attorney, provide the name & contact to your salesperson. Your attorney will be responsible for preparing the sales contract. Once an offer is made and you accept it, you should have your attorney prepare contracts immediately. If you do not have an attorney, we will be happy to provide you with several recommendations for you to consider.

Planning is the Key: Planning ahead is about preparing for the future today. It is important to make sure, that arrangements for a new home purchase or rental are typically secured prior to putting your current home on the market. Then, factor in the sales timing, which is crucial as it coincides with your need to move, and or next move. Create a “To-Do” list, outlining your next steps to use as your guide throughout the process. Appropriate planning ensures the best possible results.

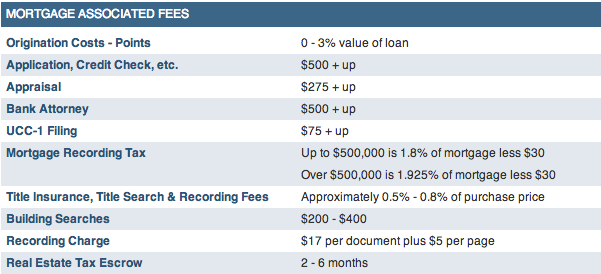

Condo Closing Costs

The biggest advantage of both condominiums and townhouses is title ownership.

J. Backer Group understands that owning a home is priceless, but closing costs do add up and should be accounted for. For this reason, we have offer additional guidance & education concerning these costs associated with the purchase of property in New York City.

The fees below are estimates only. Buyer and seller should consult with their real state attorney or financial advisor for specific transaction and further information.

CONDOMINIUM APARTMENTS / TOWNHOUSE & 1-3 FAMILY DWELLINGS

* Check with bank/mortgage broker for additional fees. New York State Law requires a written letter of engagement if the legal fee will exceed $3,000. Non New York State residents should procure exemption for state transfer tax forms (TP584). These are only estimates. Please confirm closing costs for specific transactions with your attorney and/or mortgage representative.

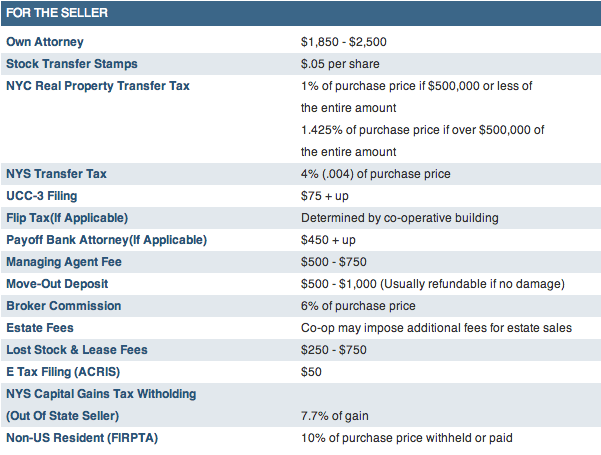

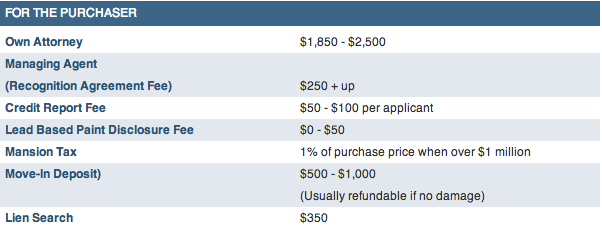

Co-op Closing Costs

Closing Cost:

CO-OPERATIVE APARTMENTS

Additional fees should settle your real estate transaction. Closing costs are additional fees that finalize the purchase of a home and are not included in the down payment or mortgage. If you are uncertain of the process, be sure to consult with your bank/mortgage broker regarding additional fees. A written letter of engagement is required by New York State Law, if your legal fees exceed $3,000. The Letter must explain the scope of the legal services to be provided, as well as an explanation of fees, expenses, and billing practices. In addition, the Letter must provide notice of the right to arbitrate fee disputes (where applicable). Non New York State residents should acquire release for state transfer tax form (TP584)

These are estimates only. Buyer and seller should consult with their attorney and/or mortgage representative regarding confirmation of closing costs for specific transactions.